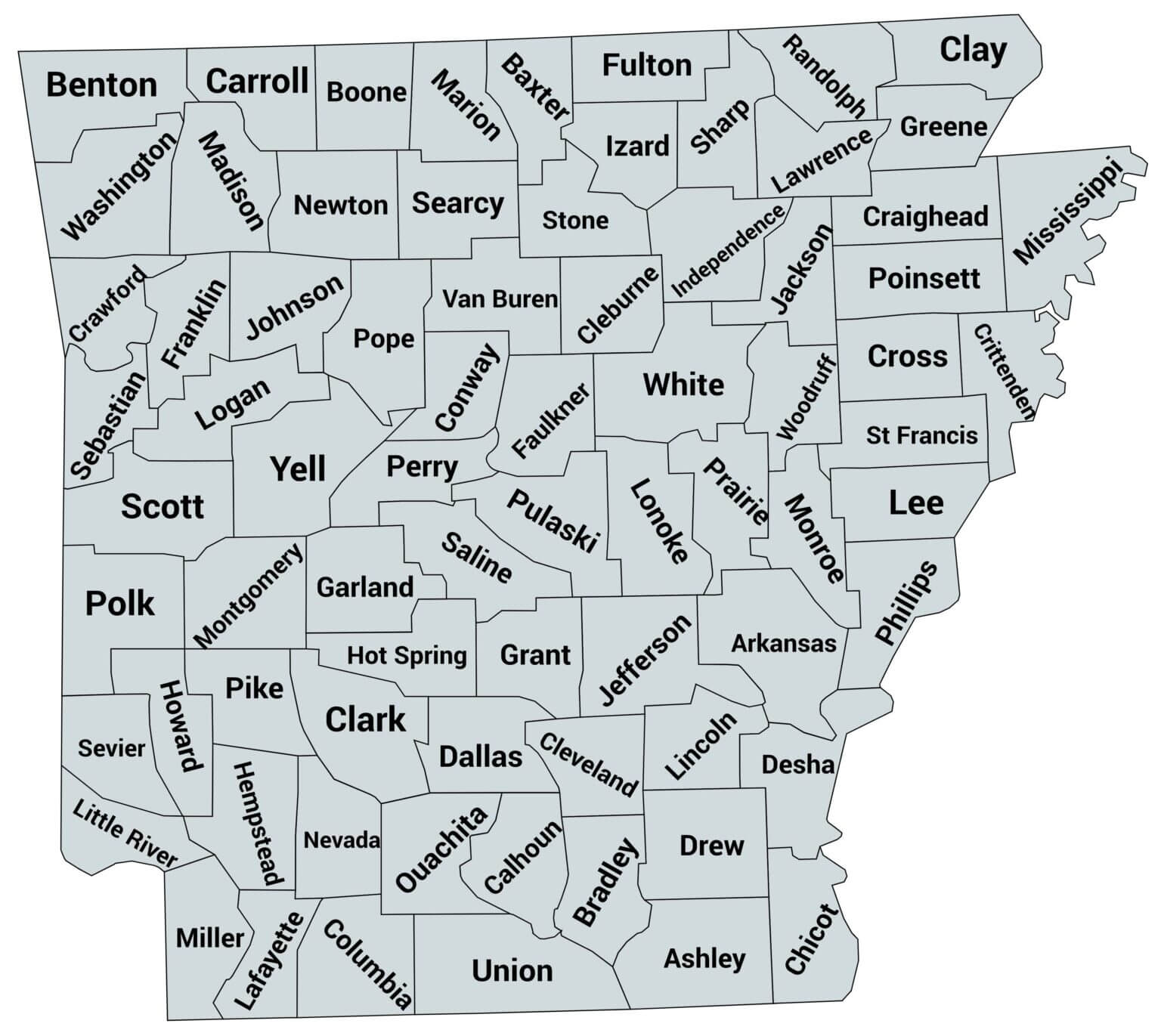

Tax Deed States 2025. The vendor only receives any refund due after their next income tax return is. What is a tax deed?

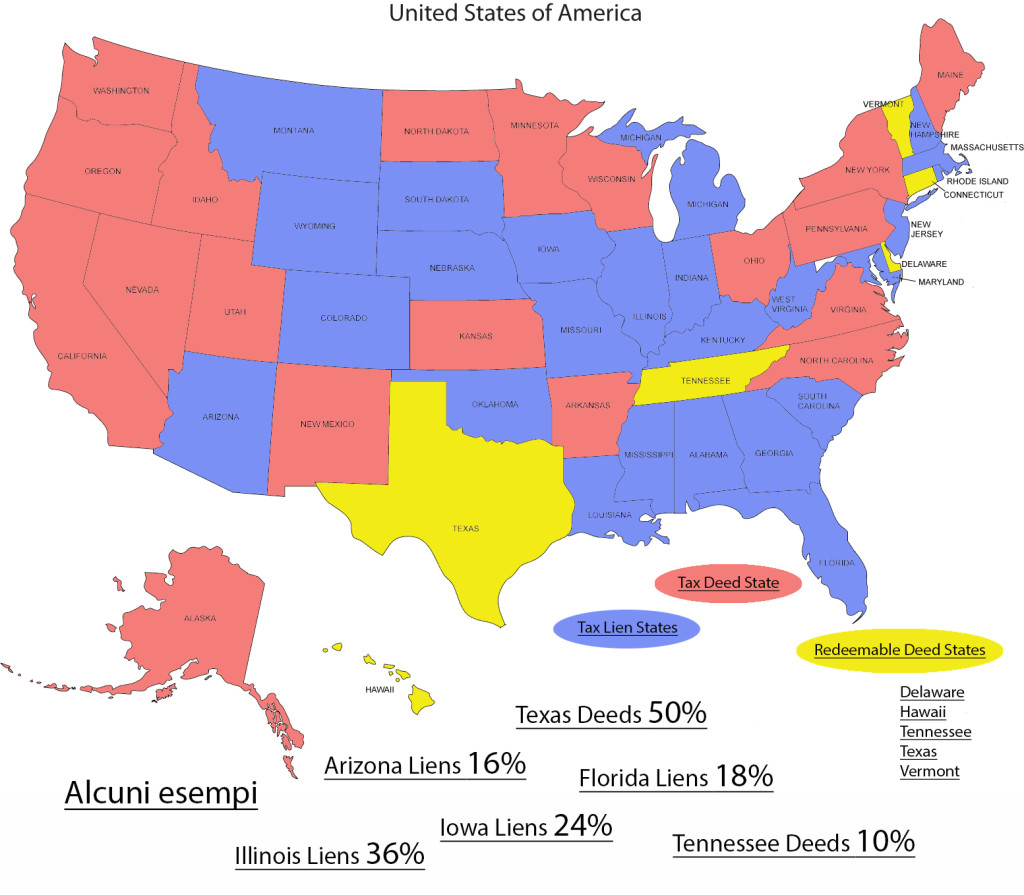

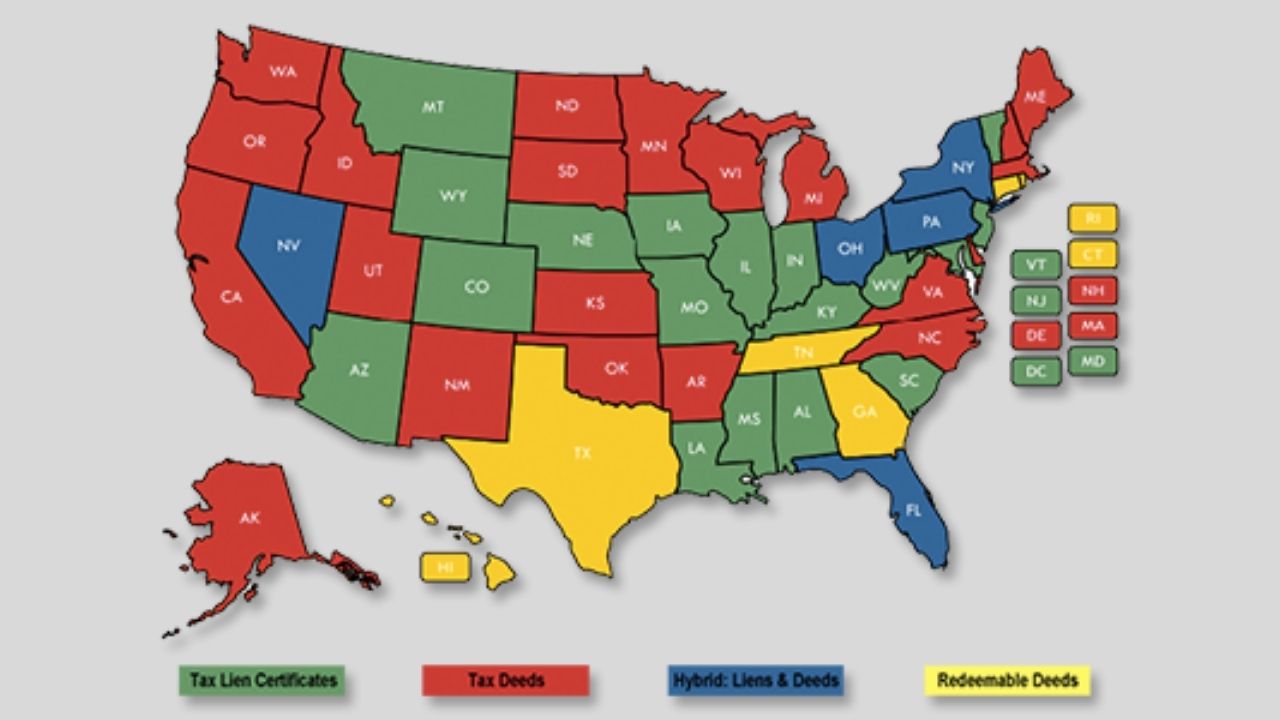

Understand the process, benefits, and strategies for successful tax deed investing Tax sale state map & state info, state laws determine how property taxes are issued and enforced.

Tax Deed States 2025 Images References :

Source: tedthomas.com

Source: tedthomas.com

Complete List Of Tax Deed States Tax Lien Certificates And Tax Deed, What i think will happen in 2025 is:

Source: tedthomas.com

Source: tedthomas.com

Complete List Of Tax Deed States, Visit the tax deed unit or the online tax deed auction to review information on the different properties offered for sale and for future tax deed sale dates.

Source: www.proplogix.com

Source: www.proplogix.com

Tax Lien Certificates vs. Tax Deeds What's the Difference? PropLogix, Understand the process, benefits, and strategies for successful tax deed investing

Source: www.youtube.com

Source: www.youtube.com

Where are the best tax lien and deed states to invest? YouTube, Which states are tax deed states?

Source: taxfoundation.org

Source: taxfoundation.org

Monday Map Nonpayers By State, You need to do your due diligence before the sale and after the sale.

Source: www.diapashome.it

Source: www.diapashome.it

Tax Liens and Deeds Certificates Diapashome, The vendor only receives any refund due after their next income tax return is processed at tax time.from 1 january 2025 however, the threshold will be removed and the.

Source: www.youtube.com

Source: www.youtube.com

Introduction to Tax Lien Investing Webinar YouTube, What i think will happen in 2025 is:

Source: www.financereference.com

Source: www.financereference.com

Tax Deed vs Tax Lien Finance Reference, A tax deed is a legal document that allows a city or county to transfer ownership of a property that has gone into tax foreclosure.

Source: www.youtube.com

Source: www.youtube.com

Tax Deed States with Real Life Case Studies YouTube, Get answers to your questions about tax deed states.

Source: taxfoundation.org

Source: taxfoundation.org

To What Extent Does Your State Rely on Property Taxes? Tax Foundation, The vendor only receives any refund due after their next income tax return is processed at tax time.from 1 january 2025 however, the threshold will be removed and the.